Patriot Letters

In the posts below, you will find articles from Life Insurance and Finance, to Real Estate Investing and the Constitution.

If you want to see a blog written about a particular topic, email your suggestions to [email protected]. Some articles are reposted from the Nelson Nash Institute's "Bank Notes."

The Mechanics of Policy Loans

One of the nicest features of whole life insurance is the ability of a policyholder to “get at his money” during the entire life of the policy, as opposed to tax-qualified investment vehicles that typically assess severe penalties for early withdrawals. Specifically, the whole life owner can take out a policy loan, gaining the use of his cash value, at any time. It is through taking out (and paying back!) policy loans that a person can use a whole life policy for “banking” purposes.

Unfortunately, it has come to our attention that some policyholders are misunderstanding this aspect of Nelson Nash’s philosophy. Indeed there have even been lawsuits, in which a policyholder claims that his agent misled him about how policy loans actually work. For example, some people claim that they were told that interest payments on policy loans go right back into their policy, as opposed to the insurance company.

This is an important and subtle issue that an insurance agent must understand completely, in order to properly explain whole life policies to potential clients. To reiterate, this isn’t a mere pedantic quibble over sales pitches; there have actually been lawsuits filed because of such confusion.

In the present article we’ll walk through a very simplified example of financing a new car purchase, with and without policy loans. The primary goals are to show the advantage of self-financing through policy loans, but also to show the sense in which it is true—and the sense in which it is FALSE—to say a policyholder “just pays himself back” the loan.

Buying A Car The American Way

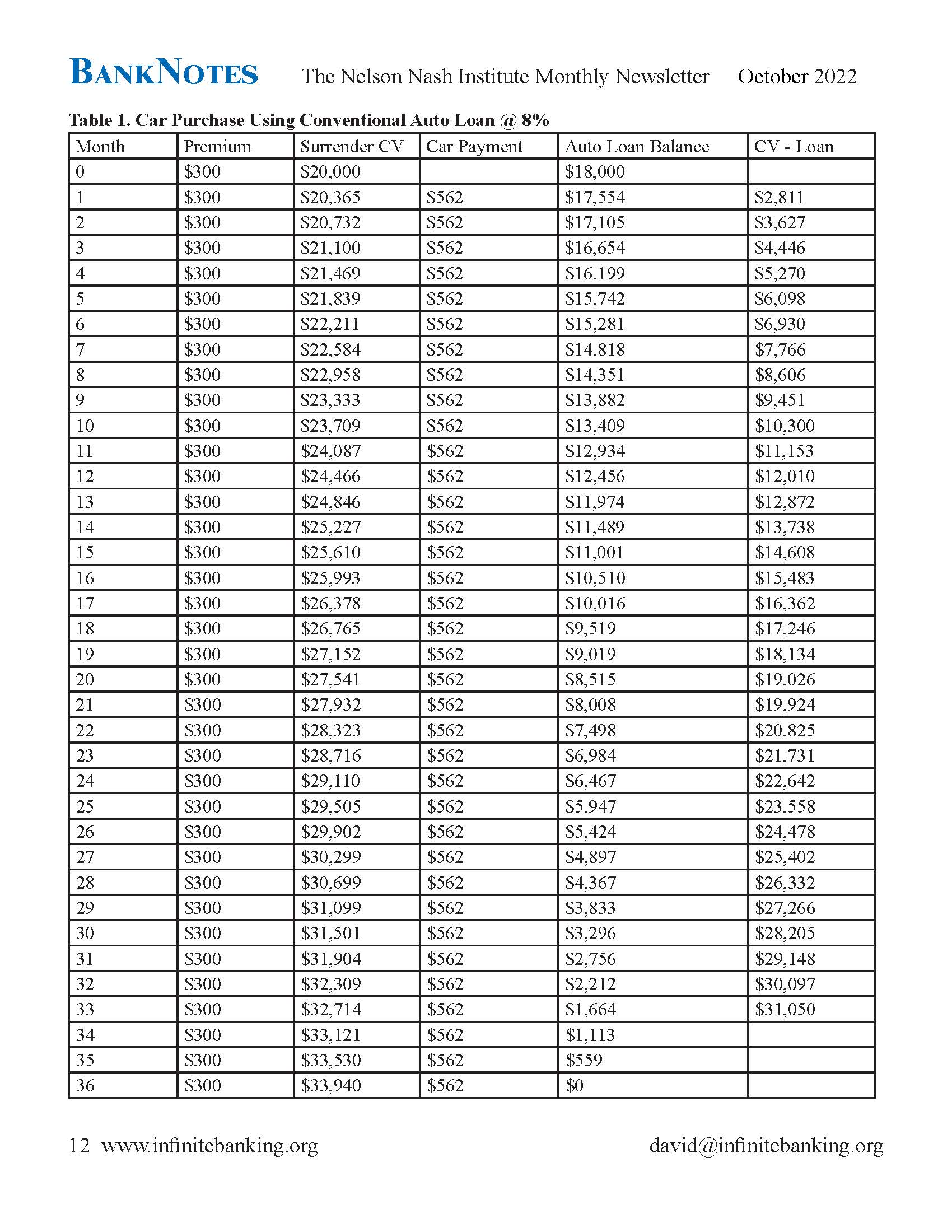

Table 1 at the back of the article illustrates a hypothetical purchase of an $18,000 new car. The new buyer goes to an outside financial institution (such as a conventional bank) and borrows the entire $18,000 at an 8% annual interest rate. If he takes out a 3-year loan, the borrower must make 36 monthly payments of $561.73 monthly in order to retire this debt. In Table 1, you can see the outstanding Auto Loan Balance start at $18,000 (the initial price) and gradually get knocked down to $0 by the last month.

Meanwhile, the car buyer also has a whole life insurance policy, with a monthly premium of $300. For the purposes of this article on policy loans, I have modeled the Surrender Cash Value of the policy as if it were a simple savings account, rolling over at a 4% annual rate. In reality, things are a lot more complicated than that, because the rate of cash value appreciation depends on many factors. However, in this article I want to keep things as simple as possible, in order to focus on policy loans. (Future articles will explain more accurately how “surrender cash value” is calculated and what factors affect its growth.)

As each payment on the car is made, our hypothetical man’s net financial assets increase. For example, in Month 10, the man’s cash value is $23,709, while his outstanding auto loan balance is $13,409, meaning his net financial assets are $10,300.

After the 36th payment is made, the man owns his car free and clear, and his $33,940 in cash value is no longer offset by any outstanding loan. (The bottom right cell of Table 1 shows a figure of $33,939, which is due to the vagaries of rounding to the nearest dollar.)

Getting Smarter…

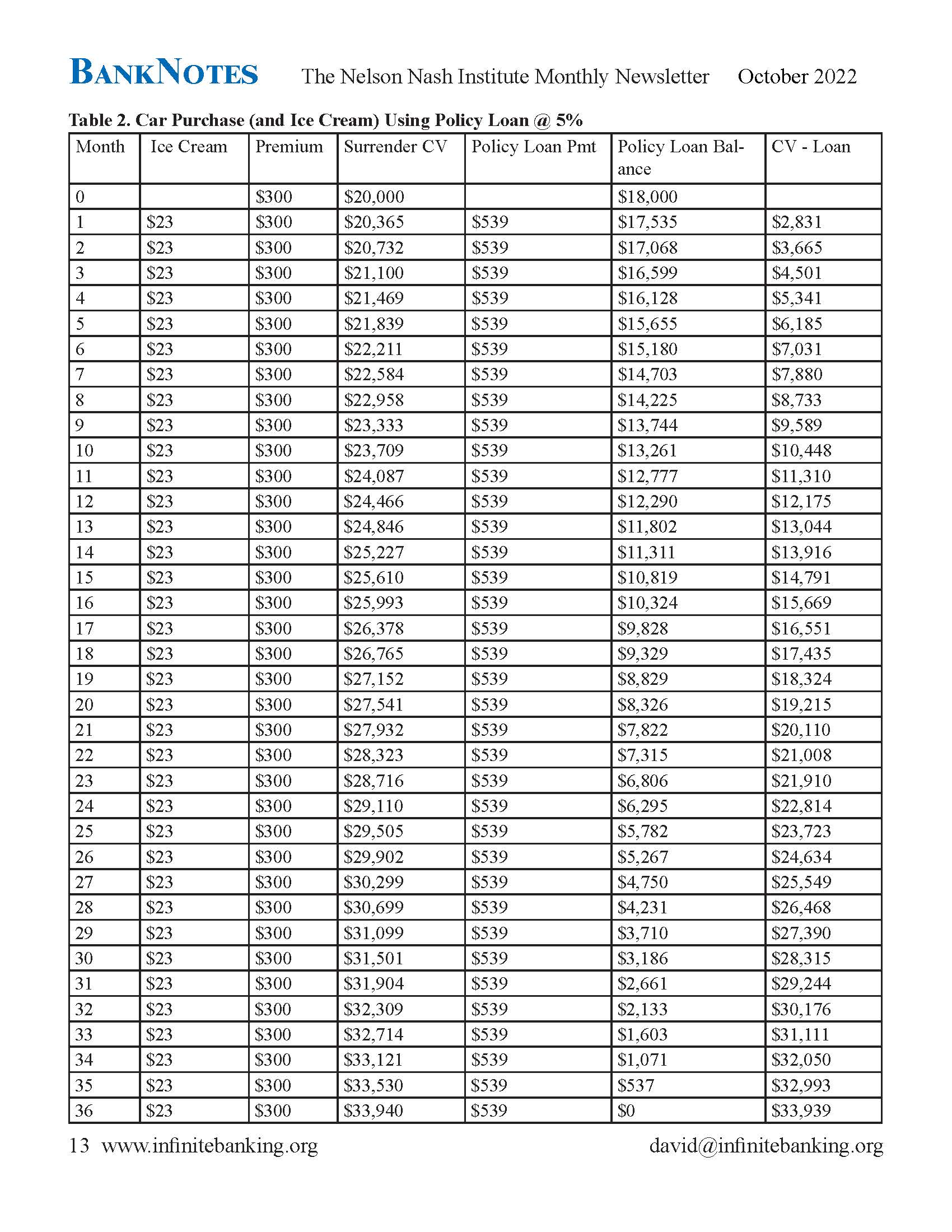

As most readers undoubtedly recognize, there is a different option available to finance the car purchase. Our hypothetical man can borrow $18,000 from the insurance company to buy his new car. Since he has an initial $20,000 in cash value, the insurer will be willing to cut him the check—no questions asked. Moreover, the interest rate on the policy loan will be lower; in this example I’m picking the round number of 5%. (See Table 2.)

Already we see the tremendous advantages of self-financing through a whole life policy loan, rather than seeking funds from a conventional lender. When our man approached a bank to buy the car in the first scenario, they would have required him to fill out paperwork, report his income, let them check his credit, tell them about the vehicle, explain his payback schedule, etc. etc. In contrast, the insurer company doesn’t care in the slightest what the $18,000 loan is for, and doesn’t care how (or if!) he plans to pay back the loan. (However, there are some slight complications with large policy loans, as I’ll explain in the last section of this article.)

As we explain in our book, How Privatized Banking Really Works, and as I stress in presentations on the topic, the explanation for this vast difference in treatment is the nature of the collateral. When a conventional bank lends someone $18,000 to buy a new car, if the person defaults then the bank has to seize the vehicle. This is a messy process that the bank wants to avoid. That’s why it will take steps to make sure the $18,000 is likely to be paid back by the borrower.

In contrast, when a person takes out a policy loan, HE IS BORROWING MONEY FROM THE INSURANCE COMPANY, but the collateral on the loan is the cash value of his policy. To repeat, the borrower is indeed taking a loan of the insurance company’s money; his own cash values are still “in” his policy.

The nature of the collateral explains why the insurer gives out loans to policyholders on such convenient terms. If our man doesn’t pay back the $18,000, the insurance company isn’t going to seize his car—remember, they don’t even know that he bought a car with the money. Instead, the insurer will “get its money back” whenever it otherwise would have owed a payment on the policy. For example, if the policyholder dies, then the death benefit to his beneficiary will have the outstanding policy loan balance deducted, before going out.

Looking at Table 2, we can see that the lower interest rate on the policy loan (versus the conventional auto loan) frees up an extra $23 per month in cashflow. This is because an $18,000 loan amortized over 36 months at a 5% interest rate only requires a monthly payment of $538.57.

In other words, if our man buys his new car using a policy loan, then every month he will find himself with an extra $23 (roughly) because of the lower payment, made possible simply because of the lower interest rate.

In this intermediate scenario, our man takes that extra $23 and spends it on ice cream each month. By the end of the 3 years, he is in a similar situation as we depicted in the first scenario—he has the car, no outstanding loan, and about $33,939 in available cash balance.

But clearly our man has benefited from going the policy loan route, since he enjoyed 3 years of ice cream treats that didn’t affect his cashflow in other areas. Another benefit is that his net financial assets—his surrender cash value minus his outstanding loan balance at any given time—were higher during the life of the loan.For example, look at Month 10. Recall that in Table 1, the net financial assets were $10,300. Yet in Table 2, we see that in Month 10 our man has net financial assets of $10,448, a difference of $148. In this particular example, the difference between the two columns grows to $190 by Months 18 and 19, and then shrinks back to $0 by Month 36.

I am an economist, so I want to stress that even when it comes to the magic of whole life insurance, there are no free lunches. Thus far, it seems that it’s a no-brainer for the man to finance the car via a policy loan, as opposed to a conventional auto loan. In the overwhelming majority of cases, that’s probably true.

However, just to underscore the nature of policy loans, let me bring up one type of case where a family might regret this approach. Specifically, suppose the man has a heart attack and dies three months after buying his new car. His wife (now widow) gets the death benefit check from the insurance company, and sees that they have deducted $16,599 from what it otherwise would have been. Now she owns the car free and clear.

Yet maybe she doesn’t want the car, and has to sell it very quickly at a rock bottom price to raise cash. This is because she’s up to her eyeballs in other debts that she and her husband had accumulated. Because her husband hadn’t taken out a very big policy, even with the insurance company’s check, the widow still can’t satisfy the outside creditors. She realizes that if her husband had taken out a conventional auto loan, as opposed to borrowing money from the insurance company using his cash value as collateral, then the widow could have “stuck it” to the bank and let them impound the car. In that case, she would have had a higher death benefit check, and would have offloaded the hassle of selling the used car to the bank.

I should point out that this is a very contrived example; it took me a few minutes to even think through how it would be possible for someone to regret using a policy loan to finance a car purchase. Nonetheless, those using whole life policy loans should understand the pros and the cons. Remember, the reason the insurer gives such good terms on the loan is that they have very liquid collateral—namely, the cash building up in the policy. In our contrived example, it was the widow who ended up with the illiquid asset (the used car) that the conventional bank didn’t want to get stuck with, either. (And remember, it was precisely to avoid being stuck with the used car that the conventional bank charged a higher interest rate, and asked a lot more questions, before granting the loan.)

There’s one more point to make about our second scenario, where the man buys the car (and ice cream) using a policy loan. Look at the columns for the Surrender Cash Value in Tables 1 and 2. They are identical. The policy loan in both cases sits in the corner, chugging along, growing with the internal appreciation as well as the stream of $300 monthly premium payments.

To a first approximation, an insurance policy isn’t affected by a policy loan, if the borrower simply pays back the loan without kicking any more money into his policy. (This actually isn’t quite right, because there are complications. For example, some insurers adjust dividend payments based on whether a policyholder has a loan out; this is the direct versus non-direct recognition issue. Also, to the extent that policy loans redirect the assets into which the insurer invests, its earnings could change and therefore influence dividends. But these are very subtle points that we can safely ignore in this introductory article.)

Therefore, in this intermediate scenario where the man buys a car with a policy loan, and just pays the bare minimum to retire the loan over 36 months—using the freed-up cashflow to buy ice cream—it’s a bit misleading to say he’s “paying the interest to himself.” What is true is that his prior history of premium payments into his policy are still doing their thing, chugging along and raising the cash value. In contrast, if he had had $20,000 in a savings account at the bank, and withdrew $18,000 to pay cash for the car, then he would only have had $2,000 rolling over in the savings account, not the full $20,000. This is the distinction financial advisors have in mind, when they stress the “opportunity cost” of buying an asset by drawing down other savings vehicles, versus borrowing against a whole life policy.

To reiterate, everyone should be clear that the man in this second scenario is contractually obligated to pay interest to the insurance company. They lent him the money, and merely used his cash value as collateral on the loan. He is literally paying the interest to the insurance company.

Before leaving this section, we should make one final clarification. The “loan payment” in this second scenario consists mostly of principal repayment, not interest. For example, in Month 10, the man pays $539 to the insurer to knock down the loan balance. Of that amount, $483 went towards reducing the principal on the loan (from $13,744 to $13,261). The remaining $56 was a pure interest payment to the insurance company. Of course, as the loan matures, a higher a higher portion of each monthly payment goes toward knocking out the principal, as opposed to paying the pure interest charged by the insurance company.

It is defensible if someone wants to say that our man is mostly “paying himself back” each month, in this second scenario. After all, to the extent that a monthly payment of $539 knocks down the outstanding policy loan balance, then it reduces the insurer’s lien on the man’s cash value. Thus it is correct to say that the man is replenishing his net financial assets with every dollar he knocks off of the loan balance, and in that sense he is “paying himself back.”

But to be absolutely clear, the pure interest component of each monthly payment, does indeed go to the insurer. (The only way it accrues to the policyholder is in the broad sense that his dividend payments are a reflection of the insurer’s return on its investments, one of which is its loan to him. Yet here his particular interest payment is getting spread out over all policyholders; he’s certainly not just “paying himself” the interest.)

Buying A Car The Nelson Nash Way

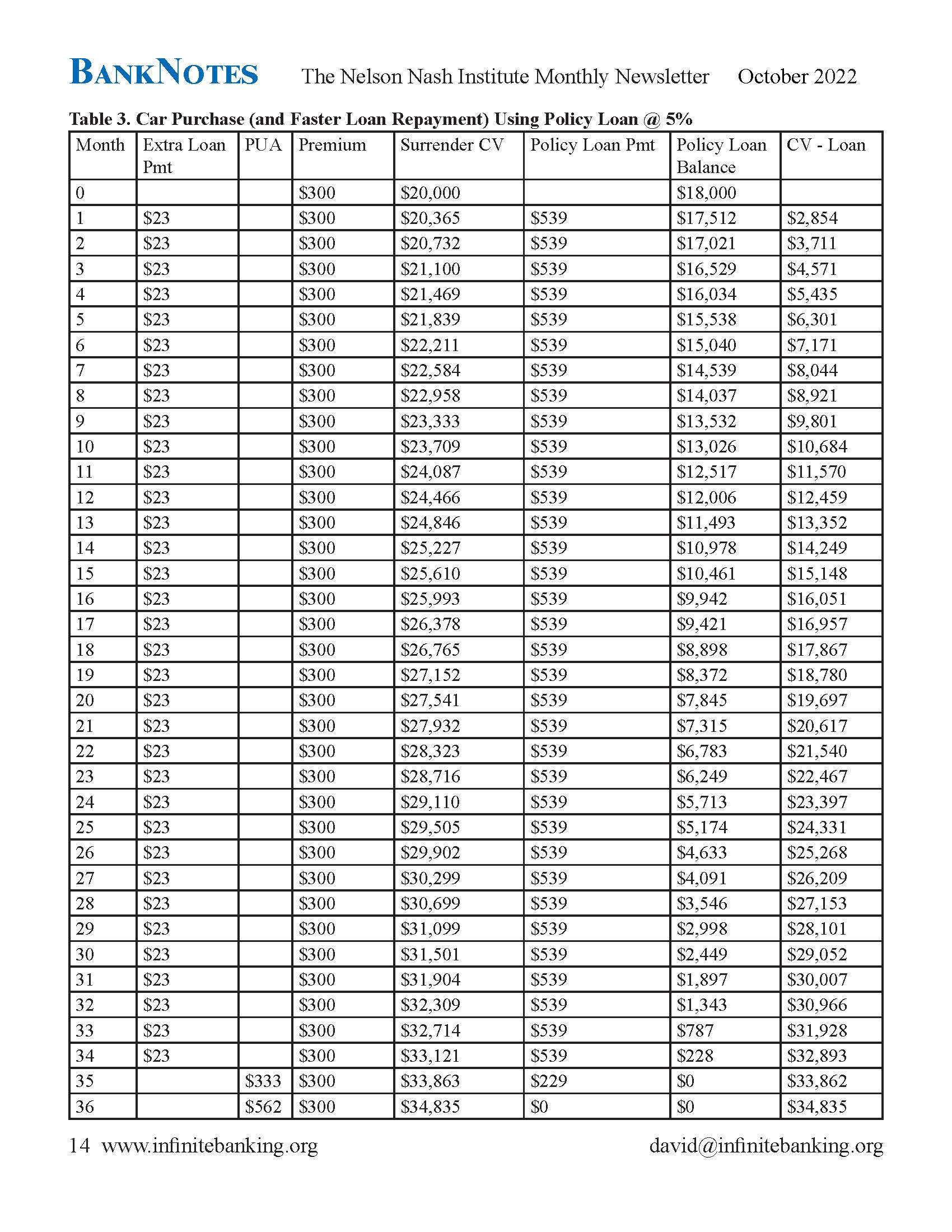

In his classic Becoming Your Own Banker, Nelson Nash recommends that people finance their large purchases using policy loans, but that they pay them back at the interest rate a conventional lender would have charged.

I’ve sketched this approach in Table 3. Here we see that instead of spending his extra $23 each month on ice cream, our man devotes it to paying off his policy loan more quickly. In other words, each month the man sends ($539 + $23) = $562 to the insurer to reduce his loan balance, just as in Table 1 he sent $562 to the conventional bank each month for his auto loan.

Yet compare Tables 1 and 3. Notice that the outstanding loan balance shrinks more quickly in Table 3. This is for the obvious reason that the man is making the same monthly payments, yet the policy loan balance is rolling over at a lower rate (5% versus 8%).

By Month 34, the man only owes $228 on his policy loan, after making his normal payment. In Month 35, he pays $229 to knock it out completely, and then takes the extra $333 and uses it to buy more insurance. Then in Month 36, his entire cashflow of $562 goes to the same purpose.

Using the Nelson Nash approach, our man ends up with a paid off car, but also an extra $896 in financial assets. Moreover, during the life of the loan, his net financial assets (cash value minus loan balance) were always higher than in Table 2, with the advantage reaching $896 by Month 36.

In this last scenario, everything we said before about the nuances of “paying yourself back” still applies. On top of that, we have the obvious “paying it to yourself” of the additional purchase of insurance in Months 35 and 36.

Loans Outrunning Cash Values

One last topic we should address is the possibility of an “overloan” situation, in which an owner takes out so many policy loans that their outstanding balance threatens to overtake the surrender cash value. Since the cash value serves as the collateral on the loan, an overloan situation is somewhat analogous to being “underwater” on a home mortgage.

An overloan situation could arise if, say, someone decides (perhaps because of a job loss) to stop funding a whole life policy with premium payments, but wants to retain the death benefit coverage for as long as possible. This person might then start using policy loans to make the contractual premium payments. If the person made this decision relatively early in the life of the policy, it would eventually “eat itself up” and shut down with no net cash.

Financial advisers must be sure their clients understand how policy loans operate, especially those who plan on borrowing heavily to fund retirement income. Rather than allowing a policyholder to become “underwater,” the insurance company will simply shut down the policy if the owner doesn’t want to at least keep up with the pure interest payments on outstanding policy loans, in order to keep the balance less than the surrender cash value. This is an important point because if a policy collapses, the IRS at that point views policy loans taken out above the cost basis as taxable income. (So long as the policy is in force, the IRS treats outstanding loans as simply that—loans—and not subject to taxation, since a loan per se doesn’t constitute income.)

Conclusion

One of the most compelling features of whole life insurance is the use of policy loans to obtain access to the growing cash value in the policy. There are several advantages to financing large purchases through policy loans, rather than seeking loans from traditional lenders such as commercial banks.

However, financial advisors and insurance agents should be careful when telling their clients that with a policy loan they are “paying it back to themselves.” In a certain sense this is basically correct, but strictly speaking the policyholder really is borrowing the money from the insurance company, and the pure interest on the loan is going to the insurer, not “into” the policy.

We only work with the BEST

For over a hundred years, few companies have weathered the storms of war, economic turmoil, and market crashes. Fewer still have survived without losing money any money. The companies we choose to work with have been turning a profit and ensuring the owners are well-paid for over 100 years.

With the Liberty Asset, you are the owner!